By Antonio Ray Harvey | California Black Media

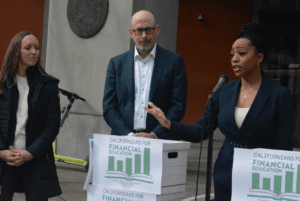

Shown right to left are State Controller Malia Cohen, Next Gen Personal Finance’s co-founder Tim Ranzetta., and Berkeley High School personal finance educator Crystal Rigley in front of the Secretary of State building in Sacramento on March 12, 2024. Ranzetta submitted over 880,000 signatures for an initiative to be placed on the November General Election. The measure, if approved by voters, would require high school students to take a personal finance course before graduation. CBM photo by Antonio Ray Harvey

(CBM) – California State Controller Malia Cohen and several other State officials — including Assemblymember Kevin McCarty (D-Sacramento) and State Superintendent for Public Instruction Tony Thurmond – are backing a ballot measure that will make California Students more financial literate.

On March 12, California for Financial Education, a non-partisan coalition of the bill’s supporters,submitted 880,000 signatures to Secretary of State Shirley Weber’s office to qualify the California Personal Finance Initiative (CPFEI) for the statewide November 2024 General Election ballot.

The initiative would guarantee that every high school student in the state completes a one-semester personal finance course as a graduation requirement. If the proposal makes it onto the ballot and passed by the voters, the graduation requirement for a standard high school diploma could start as early as 20230.

Next Gen Personal Finance is a nonprofit organization that provides curriculum and teacher training at no cost to nearly 100,000 educators nationwide, including 6,000 in California.

“According to an August 2023 poll from Binder Research, this initiative allows California to join 25 other states who have already made this commitment and are guaranteeing personnel finance education to high school students,” said Next Gen Personal Finance’s co-founder Tim Ranzetta. “There’s a finance education movement happening in this country with 17 of those 25 states committing just in the past three years. It’s time that California Students receive the same opportunity to learn these essential skills.”

Ranzetta attended the news conference, held in front of the Secretary of State building. to announce the submission of the signatures with Cohen, and Berkeley High School personal finance educator Crystal Rigley.

The (CPFEI) addresses educational disparities while ensuring every California student can acquire critical life skills. Ranzetta said 546,651 valid signatures were needed to qualify an initiative for the November 2024 ballot.

In March 2023, Thurmond stated thatOnly 27% of California high school students attend institutions that provide personal finance classes.

In August 2022, Thurmond announced that he secured $1.4 million in private funding for teachers in California high schools to receive professional development training, courtesy of Next Gen Personal Finance, to teach financial literacy.

“It is crucial as it addresses the pressing need for financial literacy among our youth, empowering them with essential skills to navigate the complexities of personal finances,” Thurmond said in a March 12 statement issued by CPFEI.” It fosters economic empowerment, bridges equity gaps, and, I believe, it will secure brighter economic futures for all.”

Rigley said making the high school course a requirement in California exposes students to the necessities of using a budget, building a good credit score, investing in the stock market, and helping them understand the advantages of using an individual retirement account (IRA).

Rigley teaches the basics of personal finance literacy at Berkeley High School, where the student population hovers around 3,200 pupils. During the current 2023-2024 school year, 12% of Berkeley High students were African American, White 20,9%, 15.1% Hispanic, and 7.8% Asian.

“All our young people deserve to enter adulthood with the money skills and confidence they need to thrive as adults,” Rigley said. “Although California leads the nation in many areas, we are severely failing our children with it comes to financial education.”

Making the course a requirement for graduation has faced challenges. While many experts favor including it in core curricula across the state, others see view it as yet another course that could be an obstacle to students completing their requisites for graduation. This could impact the Black graduation rate. According to the California Department of Education, only 76.8% of Black students in the state graduated from high school in 2019-2020 and 72.5% in 2020-2021.

McCarty introduced Assembly Bill (AB) 984 last year. The legislation intended to mandate a financial literacy course for all high school students in California by the 2025-26 school year. He pulled it from consideration by the Assembly in May of 2023 without issuing an explanation.

CPFEI first announced that it would gather the signatures for a ballot measure in September, Ranzetta said.

According to (CPFEI), research shows that personal finance education results in fewer defaults and higher credit scores among young adults; lower usage of high-cost borrowing (e.g., payday loans); more students applying for scholarships and federal financial aid instead of taking out private student loans; and more people, in general, saving for retirement.

Currently, Alabama, Iowa, Mississippi, Missouri, Tennessee, Utah, and Virginia all require students to enroll in at least one personal finance course to graduate.

State Treasurer Fiona Ma, and Los Angeles Community College Board Trustee Nichelle Henderson also support the initiative.

Cohen said she has traveled across California to talk with parents about the importance of financial literacy. It’s an issue that “everyone agrees” with, she stated.

“This is a matter that is critical to the health and vitality of the entire state of California,” Cohen said. “What we are proposing here is an initiative that will continue to uplift and educate people but also reinforce critical thinking skills and good financial habits.”

Antonio Ray Harvey

Antonio (Tony) Ray Harvey was born and raised in Champaign, Illinois, but has resided in Sacramento, California for 32 years. He graduated with a Bachelor of Arts degree in journalism and a minor in photography from California State University, Sacramento.

Aside from reporting on local entertainment, community issues, city government, and political events at the California State Capitol, Harvey is also a freelance sports journalist in Northern California. He covers the National Basketball Association, the National Football League, and NCAA sports.

Harvey is a freelance reporter for California Black Media, is also the author of the Homicidal Handyman of Oak Park: Morris Solomon Jr. at Johnston College on the University of Redlands Campus 1974-76 and recently was awarded a Doctorate of Humane Letters from CSUSB in 2014